What are the pros and cons of investing in silver bullion? If you’re wondering if silver bullion is the right investment, read on to learn why now may be a great time to start investing in silver bullion.

Investing in silver bullion has pros and cons, and what’s right for one investor may not work for another.

There’s growing Interest in the silver market when silver price start to increase. It’s during this time when investors begin to wonder if it’ is the right’s a good time to starting adding physical silver to their investment portfolios. Silver can still be volatile, but this precious metal is also viewed as a safe-haven asset, very similar to gold. Safe-haven investments can offer protection in times of uncertainty, and with tensions running as high as they are now, it’s a sound investment choice for those of you that are looking to preserve their wealth.

What Are The Pros Of Investing In Silver Bullion?

1. Silver can protect your wealth — As we briefly touched on earlier, silver is known as a safe-haven asset. In times of trouble and turmoil, investors often look to precious metals to safe guard their wealth. When political and economic uncertainty are rife, legal tender generally takes a backseat to assets like gold and silver. Both metals play similar roles when added to a portfolio, but the white metal tends to get overlooked in favor of gold.

2. It’s a tangible asset — Although cash, bonds, and mining stocks are accepted forms of wealth, they are still digital promissory notes. Due to this, they are all vulnerable to depreciation due to actions like printing money. A troy ounce of silver bullion, on the other hand, is a finite tangible asset. That means that, although it is vulnerable to market fluctuations like other commodities, physical silver isn’t likely to completely crash because of its inherent and real value. Market participants can buy bullion in different forms, such as silver coins or silver jewelry, or they can buy silver bullion bars.

3. Silver is priced better — Compared to gold bullion, the white metal is not only less expensive and therefore more accessible to buy, but it’s also more versatile to spend. That means if you are looking to buy silver in the form of a coin to use as currency, it will be easier to break than a gold coin because silver has a much lower value. It’s common to see stores today not taking bills higher than $20, cashing a $100 would definitely be a huge challenge. As a result, silver bullion is more practical and versatile.

4. Gold Silver Ratio — At the time this is being written, the Gold Silver Ratio is 89. That means you would need 89 ounces of silver to equal one once of gold. When the first coins were made over 2,500 years ago in ancient Greece, the ratio of gold to silver was generally between 10:1 and 15:1, depending on the relative proximity of gold or silver mines. In the 1930’s and 1940’s the ratio reached 90:1 or higher, and in 1991 it peaked at about 98:1, it has been well over 100:1 also. With the white metal is currently worth around 1/89th the price of gold, buying silver bullion is affordable and stands to see a much bigger percentage gain if the silver price goes up. In fact, silver has outperformed the gold price in bull markets, some are calling for 2024 to be a bull market.

5. History says silver can be trusted — Silver and gold have been used as legal tender for thousands of years, and that lineage lends them a sense of stability. Many buyers find comfort in knowing that silver has been recognized for its value throughout a great deal of mankind’s history, and so there’s an expectation that it will endure while a fiat currency may fall to the wayside. When individuals invest in physical silver, there is a reassurance that the metal has value that will continue to persist.

6. Silver and future use case – The good news for those of you that stack silver bullion, silver has a bright outlook. Silver is used in a lot of different ways besides just jewelry, bullion, and coinage. Silver has high demand in solar panels, silver also has high demand in batteries. With the solar panel industry growing by leaps and bounds, we expect more and more silver to be used. Silver is becoming more rare as we go on and that may spell a deep run and possible new highs in the near future.

What Are The Cons Of Investing In Silver Bullion?

1. Turning silver to cash — For those of you that hold physical silver, it may be tough to turn that silver into cash. If you need to get groceries or pay the electric bill, you won’t be able to pay it using silver bullion bars or a silver bullion coins, you would need to convert silver to cash. If you don’t have access to a silver bullion dealer or coin shop, it may be a challenge to convert your silver to fiat cash.

2. Theft is always a risk — Many investments such as stocks, ETFs, and digital assets like crypto don’t require physical space to hold. If you’re holding silver bullion, you’re always at risk and vulnerable to theft. The more silver you have, the higher the risks. We always recommend investing in security, that could be cameras, alarms, and safes.

3. Silver has a low ROI versus other assets — Although silver bullion may be a good safe-haven asset, it really hasn’t performed as well as other assets, such as Bitcoin, real estate or even other precious metals. If your goal is ROI, you may want to consider trying silver mining stocks, especially if those silver stocks pay dividends. Royalty and streaming companies are another option for those interested in investing in silver, as are exchange-traded funds and silver futures.

4. High silver demand leads to higher premiums — We’ve seen a lot of interest in silver in 2023 as prices peaked around $27 an ounce. When investors try to buy any bullion product, such as an 1oz American Silver Coins – also called the silver eagle, they quickly find out that the physical silver price is usually way higher than the silver spot price due to premiums. In 2023, we were seeing silver eagles holding $10-$13 an ounce premiums. Over the last few months and as we’re now in 2024, those premiums have been coming down. Still, if demand is high, premiums can go up fast, making the purchase of physical silver bullion more expensive and a less attractive investment.

How To Add Silver Bullion To Your Stack

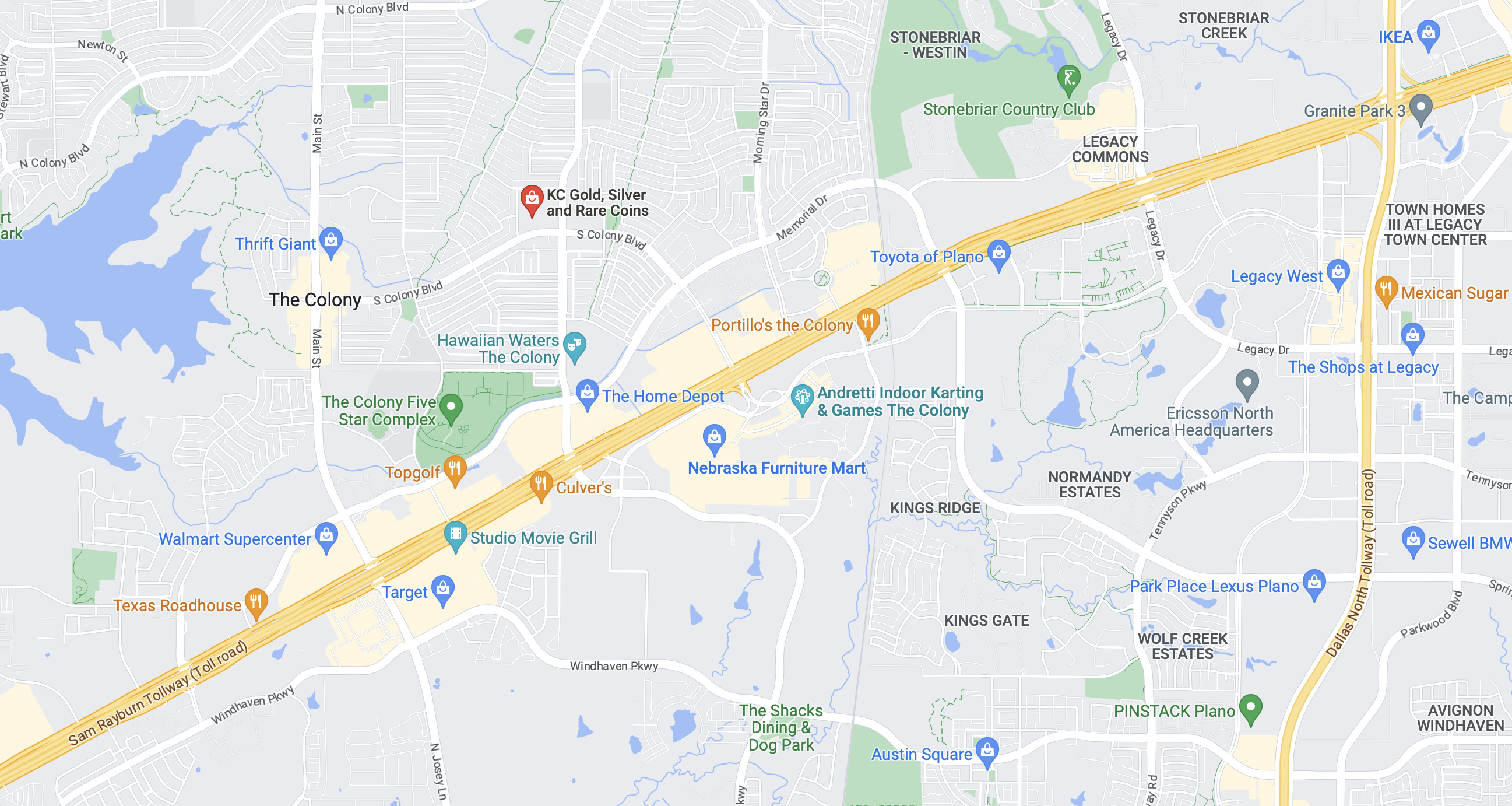

If you’re looking to buy silver bullion for your stack, we have you covered, we have a wide selection of silver bullion for sale. We can help you buy silver bars, silver rounds, silver American Eagles, and much more. Be sure to give us a call, or use this form to reach out.